The share

- Stock chart

- Basic information

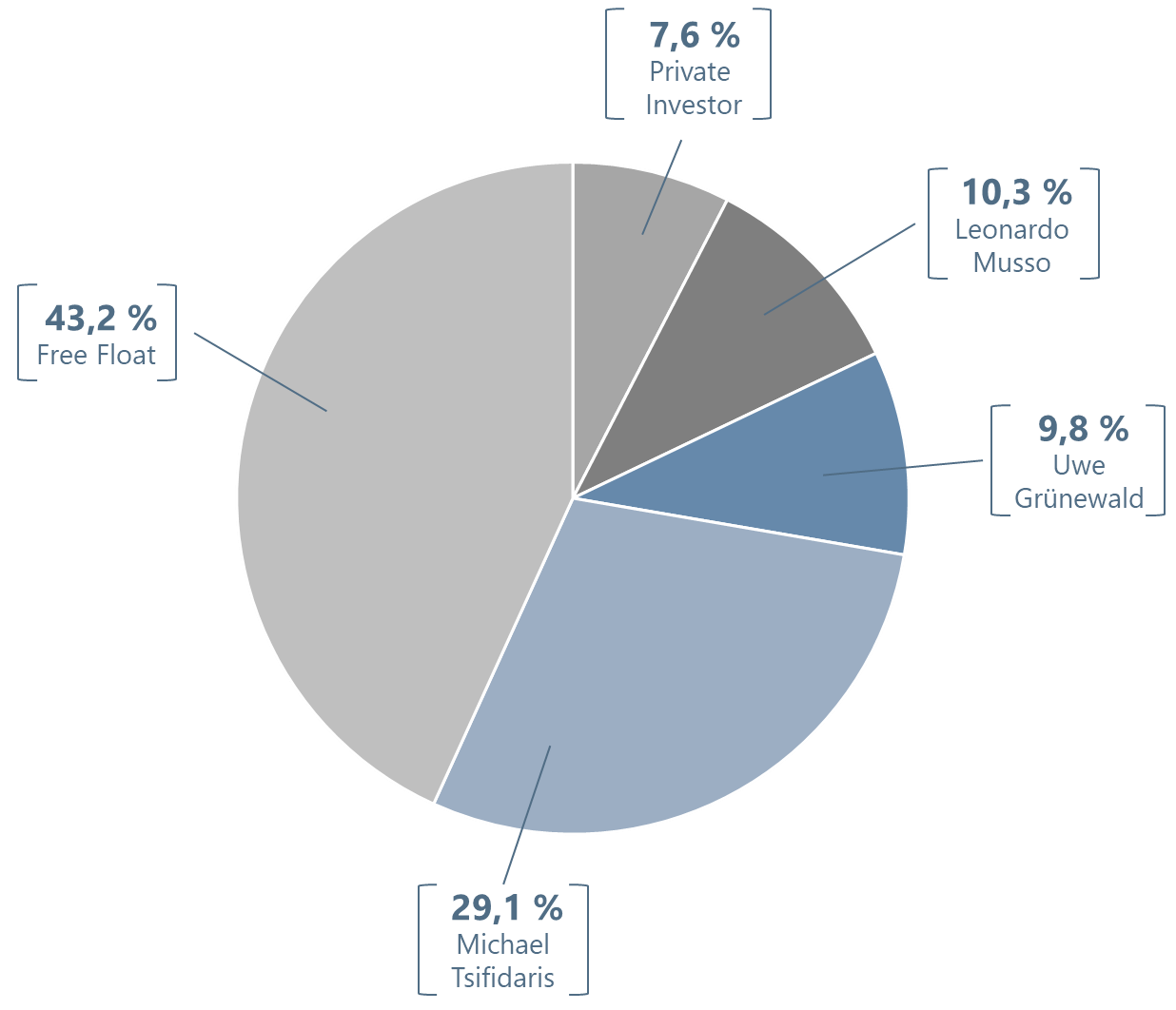

- Shareholder structure

- Dividend

DE000A1A6V48 / A1A6V4

KSC

registered no-par value ordinary shares

July 14, 1999

41.153.300

Frankfurt, Stuttgart, Hamburg, Berlin-Bremen, Dusseldorf, Munich, XETRA

Hauck & Aufhäuser Privatbankiers AG

Regulated market

Prime Standard

Landesbank Baden-Württemberg

Am Hauptbahnhof 2

70173 Stuttgart

Disclosures are based on the voting rights notifications received pursuant to the Securities Trading Law, WpHG (status: 09 December 2022) and company information; free float is in accordance with the definition of the German Stock Exchange (Deutsche Börse) with shares in the equity capital of less than 5 %.

On 10 May 2023, the Annual General Meeting of KPS AG resolved to use EUR 3,741,210.00 of the net profit for the financial year 2021/2022 of KPS AG amounting to EUR 22,914,116.14 to distribute a dividend of EUR 0.10 per no-par value share entitled to a dividend and to carry forward the remaining amount of EUR 19,172,906.14 to new account.

The dividend will be paid as of 15 May 2023 by Clearstream Banking AG, Frankfurt am Main via the custodian banks, subject to the deduction of 25% capital gains tax and 5.5% solidarity surcharge on the capital gains tax (total 26.375%) and, if applicable, church tax. The paying agent is Landesbank Baden-Württemberg, Stuttgart.

The deduction of capital gains tax as well as the solidarity surcharge does not apply to domestic shareholders who have submitted to their custodian bank a so-called non-assessment certificate from the tax office responsible for them. The same applies in whole or in part to domestic shareholders who have submitted an exemption order to their custodian bank, provided that the exemption volume has not been used up by other income from capital assets.

In the case of foreign shareholders, the withheld capital gains tax including the solidarity surcharge may be reduced in accordance with existing agreements for the avoidance of double taxation between the Federal Republic of Germany and the state concerned.

On 18 May 2022, the Annual General Meeting of KPS AG resolved to use a partial amount of EUR 7,108,299.00 of the net profit for the past financial year 2020/2021 of EUR 20,224,400.02 to distribute a dividend of EUR 0.19 per share. The remaining amount of EUR 13,116,101.02 was carried forward.

The dividend will be paid out as of 23 May 2022 by Clearstream Banking AG, Frankfurt am Main via the custodian banks after deduction of 25% capital gains tax and 5.5% solidarity surcharge on the capital gains tax (total 26.375%) and, if applicable, church tax. The paying agent is Landesbank Baden-Württemberg, Stuttgart.

The deduction of capital gains tax and the solidarity surcharge does not apply to domestic shareholders who have submitted to their custodian bank a so-called non-assessment certificate from the tax office responsible for them. The same applies in whole or in part to domestic shareholders who have submitted an exemption order to their custodian bank, provided that the exemption volume has not been used up by other income from capital assets.

In the case of foreign shareholders, the withheld capital gains tax, including the solidarity surcharge, may be reduced in accordance with existing agreements for the avoidance of double taxation between the Federal Republic of Germany and the country concerned

The ordinary Annual General Meeting of KPS AG held on 21 May 2021 resolved to appropriate a partial amount of EUR 6,360,057.00 from the net profit in the previous business year 2019/2020 in the amount of EUR 16,172,002.80 for the payout of a dividend of EUR 0.17 per share. The remaining sum in the amount of EUR 9,811,945.80 was carried forward to new account.

The payout of the dividend will be made by Clearstream Banking AG, Frankfurt am Main from 27 May 2021 through the custodian banks with deduction of 25% capital gains tax and 5.5% solidarity surcharge on the capital gains tax (total of 26.375%), and as appropriate church tax. The payment office is Landesbank Baden-Württemberg, Stuttgart.

The deduction of capital gains tax and the solidarity surcharge is not applicable for domestic shareholders who have submitted a non-assessment certificate from their responsible tax office to their custodian bank. The same applies entirely or partially to domestic shareholders who have submitted an exemption application to their custodian bank, provided that the exemption volume has not been used up by other income on capital assets.

In the case of foreign shareholders, the withheld capital gains tax including the solidarity surcharge can be reduced in accordance with the terms of existing agreements to avoid double taxation between the Federal Republic of Germany and the relevant country.

On September 25, 2020, the Annual General Meeting of KPS AG resolved to use a partial amount of EUR 6,360,057.00 of the net profit for the past financial year 2018/2019 of EUR 30,804,004.88 to distribute a dividend of EUR 0.17 per share. The remaining amount of EUR 24,443,947.88 was carried forward.

The dividend will be paid out as of September 30, 2020 by Clearstream Banking AG, Frankfurt am Main via the custodian banks after deduction of 25% capital gains tax and 5.5% solidarity surcharge on the capital gains tax (total 26.375%) and, if applicable, church tax. The paying agent is Landesbank Baden-Württemberg, Stuttgart.

The deduction of capital gains tax and the solidarity surcharge does not apply to domestic shareholders who have submitted to their custodian bank a so-called non-assessment certificate from the tax office responsible for them. The same applies in full or in part to domestic shareholders who have submitted an exemption order to their custodian bank, provided that the exemption volume has not been used up by other income from capital assets.

In the case of foreign shareholders, the withheld capital gains tax, including the solidarity surcharge, may be reduced in accordance with existing agreements for the avoidance of double taxation between the Federal Republic of Germany and the country concerned.

On 29 March 2019, the Annual General Meeting of KPS AG resolved to use a partial amount of EUR 13,094,235.00 of the net profit for the past 2017/2018 financial year of EUR 30,327,767.46 to distribute a dividend of EUR 0.35 per share. The remaining amount of EUR 17,233,532.46 was carried forward.

The dividend will be paid out as of 03 April 2019 by Clearstream Banking AG, Frankfurt am Main via the custodian banks after deduction of 25% capital gains tax and 5.5% solidarity surcharge on the capital gains tax (total 26.375%) and, if applicable, church tax. The paying agent is Landesbank Baden-Württemberg, Stuttgart. The deduction of capital gains tax and the solidarity surcharge does not apply to domestic shareholders who have submitted to their custodian bank a so-called non-assessment certificate from the tax office responsible for them.

The same applies in whole or in part to domestic shareholders who have submitted an exemption order to their custodian bank, provided that the exemption volume has not been used up by other income from capital assets. In the case of foreign shareholders, the withheld capital gains tax including the solidarity surcharge may be reduced in accordance with existing agreements for the avoidance of double taxation between the Federal Republic of Germany and the state concerned.

On March 23, 2018, the Annual General Meeting of KPS AG resolved to use a partial amount of EUR 13,094,235.00 of the net profit for the past 2016/2017 financial year of EUR 30,388,902.54 to distribute a dividend of EUR 0.35 per share. The remaining amount of EUR 17,294,667.54 was carried forward.

The dividend will be paid out as of March 28, 2018 by Clearstream Banking AG, Frankfurt am Main. The paying agent is Landesbank Baden-Württemberg, Stuttgart.

The distribution will be made from the tax contribution account (section 27 KStG). The dividend is not subject to a tax refund or tax credit.

On April 7, 2017, the Annual General Meeting of KPS AG resolved to use a partial amount of EUR 12,301,982.55 of the net profit for the past 2015/16 financial year of EUR 27,925,605.64 to distribute a dividend of EUR 0.33 per share. The remaining amount of EUR 15,623,623.09 was carried forward.

The dividend will be paid out by Clearstream Banking AG, Frankfurt am Main, as of April 12, 2017. The paying agent is Dero Bank AG, Munich.

The distribution will be made from the tax deposit account (Section 27 KStG) without deduction of capital gains tax and solidarity surcharge. No tax credit is associated with the dividend.

On April 15, 2016, the Annual General Meeting of KPS AG resolved to use a partial amount of € 10,166,927.70 of the net retained profits of € 19,520,551.45 for the past financial year 2014/15 to pay a dividend of € 0.30 per share. The remaining amount of € 9,353,623.75 was carried forward. The dividend will be paid out as of April 18, 2016 by Clearstream Banking AG, Frankfurt am Main. The paying agent is Dero Bank AG, Munich (formerly: VEM Aktienbank AG, Munich). The distribution will be made from the tax deposit account (Section 27 KStG) without deduction of capital gains tax and solidarity surcharge. No tax credit is associated with the dividend. In the opinion of the German tax authorities, the distribution reduces the acquisition cost of the shares.

Privacy settings

We use cookies on our website. Some of them are essential, while others help us to improve this website and your experience. With your consent, we use cookies to analyse the usage of our website.

We also use cookies for marketing to help us measure the success of our marketing efforts. In the settings you will find detailed information about the individual cookies, and you can refuse the use of cookies.

You can change or revoke your selection at any time on any KPS.com page in the footer under Privacy Settings.

Essential cookies enable basic functions and are necessary for the proper functioning of the website.

Cookie Banner

- Cookie Name: kps-privacy-settings

Value: PrivacyLevel_0#a

Storage Duration: 4 weeks

Description: This cookie is required to save cookie settings. It is a purely technical cookie.

HubSpot:

Cookie Name: __hs_opt_out

Storage Duration: 6 months

Description: This cookie is used by the opt-in privacy policy to prompt the visitor to accept cookies again. It is set when you allow visitors to disable cookies. It contains the string "Yes" or "No."Cookie Name: __hs_d_not_tracking

Storage Duration: 6 months

Description: This cookie can be set to prevent the tracking code from sending information to HubSpot. It contains the string "Yes."Cookie Name: _hs_initial_opt

Storage Duration: 7 days

Description: This cookie is used to prevent banners from being displayed every time visitors access your website in strict mode. It contains the string "Yes" or "No."Cookie Name: __hs_cookie_cat_pref

Storage Duration: 6 months

Description: This cookie is used to capture the categories a visitor has consented to. It contains data about those categories.Cookie Name: __hs_gpc_banner_dismiss

Storage Duration: 3 months

Description: This cookie is used when the Global Privacy Control banner is dismissed.Cookie Name: hs_ab_test

Storage Duration: Until the end of the session

Description: This cookie is used to ensure that visitors see the same version of an A/B test page they were shown previously. It contains the ID of the A/B test page and the ID of the variant selected for the visitor.Cookie Name: __cfruid

Storage Duration: Until the end of the session

Description: This cookie is set by HubSpot's CDN provider in accordance with its rate-limiting policies.Cookie Name: ___cfuvid

Storage Duration: Until the end of the session

Description: This cookie is set by HubSpot's CDN provider in accordance with its rate-limiting policies.Cookie Name: ___cf_bm

Storage Duration: Until the end of the session

Description: This cookie is set by HubSpot's CDN provider in accordance with its rate-limiting policies.

Functional cookies are used by third parties or publishers to display personalised advertisements. They do this by tracking visitors across websites.

Google Analytics

Cookie Name: _ga

Storage Duration: 2 years

Description: Used to distinguish between users.

Cookie Name: _gid

Storage Duration: 24 months

Description: Used to distinguish between users.

Cookie Name: _gat

Storage Duration: 1 minute

Description: Used to throttle the request rate. If Google Analytics is provided via Google Tag Manager, this cookie is named dc_gtm<property-ID>.

Cookie Name: hide-cookieinfo

Storage Duration: 30 days

Description: Cookie set for querying the cookies.

HubSpot

Cookie Name: __hstc

Storage Duration: 6 months

Description: The main cookie for visitor tracking. It contains the domain, the user token (hubspotutk), the first timestamp (of the first visit), the last timestamp (of the last visit), the current timestamp (for this visit), and the session count (increases with each subsequent session).

Cookie Name: hubspotutk

Storage Duration: 6 months

Description: This cookie tracks the identity of a visitor. This cookie is passed to the HubSpot software when submitting a form and is used for deduplicating contacts. It contains an opaque GUID to represent the current visitor.

Cookie Name: __hssc

Storage Duration: 30 minutes

Description: This cookie tracks sessions. It is used to determine whether the HubSpot software needs to increment the session count and timestamps in the __hstc cookie. It contains the domain, the number of page views (viewCount, increases with each page view in a session), and the session start timestamp.

Cookie Name: __hssrc

Storage Duration: End of session

Description: Whenever the HubSpot software changes the session cookie, this cookie is also set. It determines whether the visitor has restarted the browser. If this cookie is not present when HubSpot manages cookies, it is considered a new session. It contains the value "1" if present.

Content from video platforms and social media platforms is blocked by default. If cookies from external media are accepted, access to this content no longer requires manual consent.

LinkedIn Tag

Cookie Name: bcookie

Storage Duration: 365 days

Description: Browser Identifier cookie to uniquely identify devices accessing LinkedIn to detect abuse on the platform and for diagnostic purposes.

Cookie Name: bscookie

Storage Duration: 365 days

Description: Used for remembering that a logged-in user is verified by two-factor authentication and has previously logged in.

Cookie Name: JSESSIONID

Storage Duration: Session

Description: Used for Cross-Site Request Forgery (CSRF) protection and URL signature validation.

Cookie Name: lang

Storage Duration: Session

Description: Used to remember a user's language setting to ensure LinkedIn.com displays in the language selected by the user in their settings.

Cookie Name: lidc

Storage Duration: 1 day

Description: To facilitate data center selection.

Cookie Name: sdsc

Storage Duration: Session

Description: Signed data service context cookie used for database routing to ensure consistency across all databases when a change is made. Used to ensure that user-inputted content is immediately available to the submitting user upon submission.

Cookie Name: li_gc

Storage Duration: 180 days

Description: Used to store consent of guests regarding the use of cookies for non-essential purposes.

Cookie Name: li_mc

Storage Duration: 180 days

Description: Used as a temporary cache to avoid database lookups for a member's consent for use of non-essential cookies and used for having consent information on the client side to enforce consent on the client side.

Cookie Name: UID

Storage Duration: 720 days

Description: Cookie used for market and user research.

Cookie Name: UserMatchHistory

Storage Duration: 30 days

Description: LinkedIn Ads ID syncing.

Cookie Name: AnalyticsSyncHistory

Storage Duration: 30 days

Description: Used to store information about the time a sync took place with the lms_analytics cookie.

Cookie Name: lms_ads

Storage Duration: 30 days

Description: Used to identify LinkedIn Members off LinkedIn for advertising.

Cookie Name: lms_analytics

Storage Duration: 30 days

Description: Used to identify LinkedIn Members off LinkedIn for analytics.

Cookie Name: li_fat_id

Storage Duration: 30 days

Description: Member indirect identifier for Members for conversion tracking, retargeting, and analytics.

Cookie Name: li_sugr

Storage Duration: 90 days

Description: Used to make a probabilistic match of a user's identity.

Cookie Name: _guid

Storage Duration: 90 days

Description: Used to identify a LinkedIn Member for advertising through Google Ads.

Cookie Name: BizographicsOptOut

Storage Duration: 10 years

Description: Used to determine opt-out status for non-members.

Cookie Name: li_giant

Storage Duration: 7 days

Description: Indirect identifier for groups of LinkedIn Members used for conversion tracking.

Cookie Name: oribi_cookie_test

Storage Duration: Session

Description: To determine if tracking can be enabled on the current domain.

Cookie Name: oribili_user_guid

Storage Duration: 365 days

Description: Used to count unique visitors to a website.

Cookie Name: ln_or

Storage Duration: 1 day

Description: Used to determine if Oribi analytics can be carried out on a specific domain.

Cookie Name: ar_debug

Storage Duration: Session

Description: Supports Google attribution reporting API integration to mitigate signal loss.

Lead Forensics

Cookie Name: __lfluuid

Storage Duration: 10 years

Description: The _lfuuid cookie allows a website to track visitor behavior on the sites on which the cookie is installed. Tracking is performed anonymously until a user identifies himself by submitting a form.